Becoming a millionaire is a dream that many people have, but few are able to achieve. It may seem like an impossible feat to become a millionaire in just five years, but with the right mindset, strategies, and hard work, it is definitely possible. In this comprehensive guide, we will explore the steps you can take to accelerate your wealth accumulation and achieve millionaire status in just five years.

Accelerate Your Wealth Accumulation: Achieving Millionaire Status in Five Years

The first step towards becoming a millionaire in five years is to accelerate your wealth accumulation. This means increasing your income and minimizing your expenses to save as much money as possible. Here are some strategies you can use to accelerate your wealth accumulation:

Maximizing Income

The key to accelerating your wealth accumulation is to increase your income. This can be done through various ways such as getting a higher paying job, starting a side hustle, or investing in income-generating assets. Here are some tips to help you maximize your income:

- Invest in yourself: One of the best investments you can make is in yourself. This could mean taking courses, attending workshops, or getting certifications that will enhance your skills and make you more valuable in the job market.

- Negotiate for a higher salary: If you have been working at the same job for a while, it might be time to ask for a raise. Do your research and find out what the average salary is for your position in your industry. Use this information to negotiate for a higher salary.

- Start a side hustle: A side hustle is a great way to earn extra income outside of your regular job. It could be anything from freelancing, selling products online, or providing services such as tutoring or consulting.

- Invest in income-generating assets: Investing in assets such as stocks, real estate, or businesses can provide you with a steady stream of passive income. This can significantly increase your overall income and help you reach millionaire status in five years.

Minimizing Expenses

In addition to increasing your income, it is important to minimize your expenses to save as much money as possible. Here are some ways you can reduce your expenses:

- Create a budget: Creating a budget is essential for managing your finances and keeping track of your expenses. Make a list of all your monthly expenses and see where you can cut back.

- Live below your means: It can be tempting to upgrade your lifestyle when you start earning more money, but living below your means is crucial for saving and investing. Avoid unnecessary expenses and focus on building wealth instead.

- Cut back on luxuries: While it’s okay to treat yourself once in a while, cutting back on luxuries such as expensive vacations, designer clothes, and fancy dinners can save you a significant amount of money in the long run.

- Avoid debt: Debt can be a major hindrance to wealth accumulation. Avoid taking on unnecessary debt and pay off any existing debts as soon as possible.

Five-Year Plan to Financial Freedom: Becoming a Millionaire

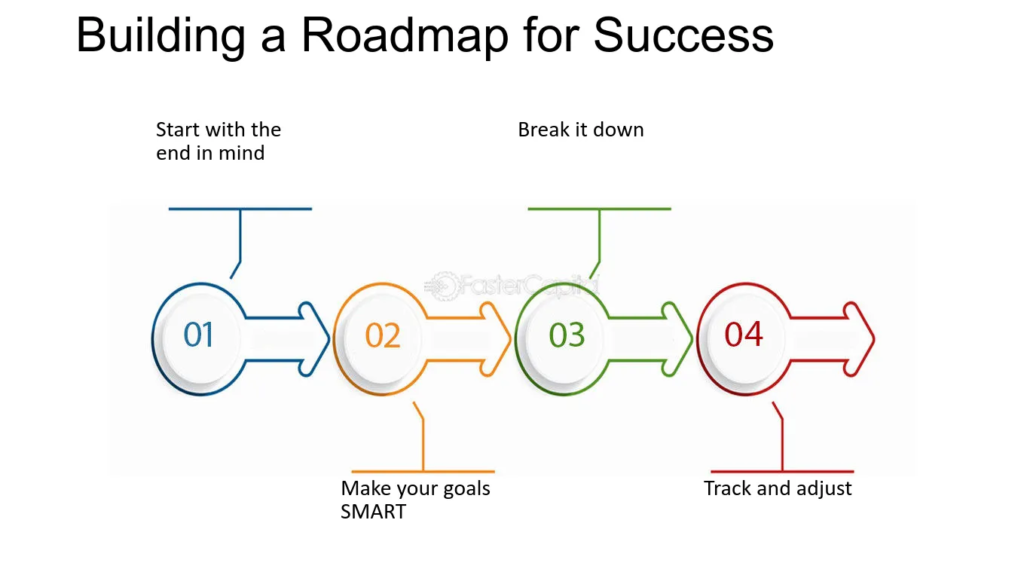

Now that you have a plan to accelerate your wealth accumulation, it’s time to create a five-year plan to financial freedom. This plan will serve as a roadmap to help you achieve your goal of becoming a millionaire in five years. Here’s how you can create a five-year plan:

Set a Specific Goal

The first step in creating a five-year plan is to set a specific goal. Instead of just saying “I want to become a millionaire in five years,” set a specific target amount that you want to achieve. This will give you a clear goal to work towards and help you stay motivated.

Break Down Your Goal into Smaller Milestones

Once you have set a specific goal, break it down into smaller milestones that you can achieve along the way. For example, if your goal is to save $1 million in five years, break it down into saving $200,000 each year or $16,667 per month. This will make your goal more manageable and less overwhelming.

Create a Plan of Action

Now that you have set a specific goal and broken it down into smaller milestones, it’s time to create a plan of action. This should include the steps you will take to increase your income, minimize your expenses, and invest your money wisely. Be as detailed as possible and set deadlines for each milestone.

Roadmap to Millionairedom in Five Years: Strategies and Success Principles

In addition to setting goals and creating a plan, there are certain strategies and success principles that can help you achieve millionaire status in five years. Here are some key strategies and principles to keep in mind:

Develop a Millionaire Mindset

The first step towards achieving any goal is to develop the right mindset. In order to become a millionaire in five years, you need to think like a millionaire. This means having a positive attitude, being persistent, and believing in yourself and your abilities. Here are some essential habits to cultivate for a millionaire mindset:

- Set clear and specific goals: As mentioned earlier, setting clear and specific goals is crucial for achieving success. Write down your goals and review them regularly to stay focused.

- Practice gratitude: Gratitude is a powerful tool for attracting abundance into your life. Take time each day to reflect on what you are grateful for and appreciate the things you already have.

- Surround yourself with successful people: The people you surround yourself with can have a big impact on your mindset and success. Surround yourself with people who inspire and motivate you to achieve your goals.

- Learn from failures: Failure is a part of the journey towards success. Instead of letting failure discourage you, use it as an opportunity to learn and grow.

- Take calculated risks: Becoming a millionaire in five years requires taking some risks. However, it’s important to take calculated risks and do your research before making any major decisions.

Practice Financial Discipline

Financial discipline is essential for achieving financial success. This means being disciplined with your spending, saving, and investing habits. Here are some tips for practicing financial discipline:

- Stick to your budget: Creating a budget is only effective if you actually stick to it. Avoid impulse purchases and unnecessary expenses that can derail your financial goals.

- Automate your savings: Set up automatic transfers from your checking account to your savings or investment accounts. This will ensure that you save a portion of your income each month without having to think about it.

- Avoid lifestyle inflation: As your income increases, it can be tempting to upgrade your lifestyle. However, avoiding lifestyle inflation and living below your means is crucial for building wealth.

- Educate yourself about personal finance: The more you know about personal finance, the better equipped you will be to make smart financial decisions. Read books, attend workshops, and seek advice from financial experts to improve your financial literacy.

Unveiling the Millionaire Mindset: Essential Habits for Financial Success in Five Years

In order to achieve millionaire status in five years, it’s important to adopt certain habits and behaviors that are common among successful millionaires. Here are some essential habits to cultivate for financial success:

Think Long-Term

Successful millionaires have a long-term mindset when it comes to their finances. They understand that building wealth takes time and are willing to make sacrifices in the short-term for long-term gain. Instead of focusing on quick wins, think about the long-term impact of your financial decisions.

Diversify Your Income Streams

Having multiple streams of income is key to building wealth. In addition to your primary source of income, look for ways to diversify your income such as investing in stocks, real estate, or starting a side hustle. This will not only increase your overall income but also provide a safety net in case one source of income dries up.

Continuously Educate Yourself

Successful millionaires are always learning and seeking new opportunities to grow their wealth. Make it a habit to continuously educate yourself about personal finance, investing, and entrepreneurship. Attend workshops, read books, and seek advice from financial experts to expand your knowledge and improve your financial literacy.

The Millionaire Mindset: Cognitive and Behavioral Shifts for Rapid Wealth Growth

In addition to adopting certain habits, there are also cognitive and behavioral shifts that can help you achieve rapid wealth growth. Here are some key mindset shifts to make:

Believe in Yourself

One of the biggest obstacles to achieving success is self-doubt. In order to become a millionaire in five years, you need to believe in yourself and your abilities. Trust that you have what it takes to achieve your goals and don’t let self-doubt hold you back.

Embrace Failure

As mentioned earlier, failure is a part of the journey towards success. Instead of fearing failure, embrace it and use it as an opportunity to learn and grow. Remember that every successful person has faced failures along the way, but it’s how they handle those failures that sets them apart.

Take Action

Having a plan and setting goals is important, but taking action is what will ultimately lead to success. Don’t get stuck in the planning phase, take action and make things happen. Even if you make mistakes along the way, it’s better than not taking any action at all.

Smart Money Moves for Aspiring Millionaires: Investment Strategies and Growth Hacks

Investing is a crucial component of becoming a millionaire in five years. Here are some smart money moves you can make to accelerate your wealth accumulation:

Start Early

The earlier you start investing, the more time your money has to grow. Even if you can only invest a small amount each month, it will add up over time. Don’t wait until you have a large sum of money to start investing, start as early as possible.

Diversify Your Portfolio

Diversifying your investment portfolio is important for managing risk and maximizing returns. Instead of putting all your money into one type of investment, spread it out across different asset classes such as stocks, bonds, real estate, and alternative investments.

Take Advantage of Tax Benefits

There are various tax benefits available for investors that can help you save money and accelerate your wealth accumulation. Make sure to take advantage of these benefits by consulting with a financial advisor or doing your own research.

Maximizing Income and Minimizing Expenses: The Art of Financial Discipline

In addition to practicing financial discipline, there are also specific strategies you can use to maximize your income and minimize your expenses. Here are some tips:

Negotiate for a Higher Salary

As mentioned earlier, negotiating for a higher salary is one way to increase your income. However, it’s important to do your research and make a strong case for why you deserve a raise. Be prepared to provide evidence of your contributions and value to the company.

Invest in Income-Generating Assets

Investing in assets that generate passive income is another way to increase your overall income. This could include dividend-paying stocks, rental properties, or businesses. Make sure to do your research and consult with a financial advisor before making any investment decisions.

Cut Back on Unnecessary Expenses

Reducing unnecessary expenses is crucial for saving money and accelerating your wealth accumulation. Take a look at your monthly expenses and see where you can cut back. This could mean canceling subscriptions, cooking at home instead of eating out, or finding ways to save on utilities.

The Power of Passive Income: Creating Multiple Streams of Wealth in Five Years

Passive income is income that you earn without actively working for it. This can be a powerful tool for accelerating your wealth accumulation and achieving millionaire status in five years. Here are some ways to create passive income:

Invest in Dividend-Paying Stocks

Dividend-paying stocks are stocks that pay out a portion of their profits to shareholders on a regular basis. By investing in these types of stocks, you can earn a steady stream of passive income.

Rent Out Properties

Owning rental properties is another way to generate passive income. You can either buy a property and rent it out yourself or invest in a real estate investment trust (REIT) which allows you to invest in real estate without the hassle of managing properties.

Create Digital Products

If you have a skill or expertise in a certain area, you can create digital products such as e-books, online courses, or software and sell them online. Once the product is created, you can earn passive income from sales without having to put in any additional work.

Achieving Millionaire Status in Five Years: Overcoming Challenges and Staying Motivated

Becoming a millionaire in five years is not an easy feat and there will undoubtedly be challenges along the way. Here are some common challenges you may face and how to overcome them:

Lack of Capital

One of the biggest challenges to becoming a millionaire in five years is not having enough capital to invest. In this case, it’s important to start small and focus on increasing your income through other means such as negotiating for a higher salary or starting a side hustle. As your income increases, you can then start investing in income-generating assets.

Market Volatility

Investing in the stock market comes with its own set of risks, including market volatility. It’s important to do your research and diversify your portfolio to minimize risk. It’s also important to have a long-term mindset and not panic when the market experiences fluctuations.

Staying Motivated

Becoming a millionaire in five years requires a lot of hard work and dedication. It’s important to stay motivated and focused on your goals, even when faced with challenges or setbacks. Surrounding yourself with like-minded individuals and continuously educating yourself can help you stay motivated and on track.

Conclusion

Becoming a millionaire in five years is definitely possible with the right mindset, strategies, and hard work. By following the steps outlined in this comprehensive guide, you can accelerate your wealth accumulation and achieve financial freedom in just five years. Remember to set specific goals, create a plan of action, and adopt a millionaire mindset to overcome challenges and stay motivated on your journey towards millionaire status.

Read more blogs : marketwatchinfo.co.uk